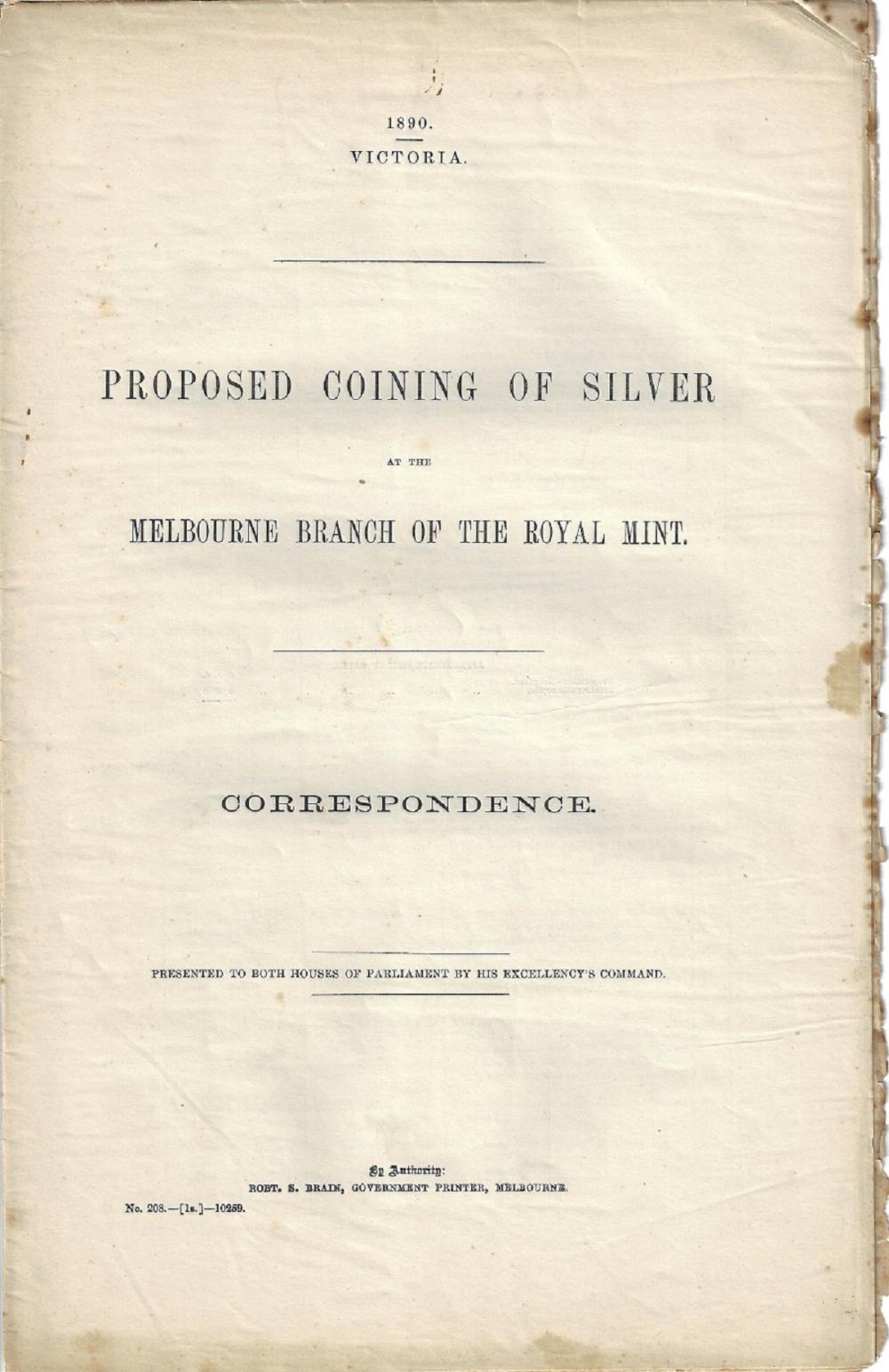

Lot 270

One of 810 original copies "presented to both Houses of Parliament by His Excellency's Command"

-

Exhibited:

- 520 Literature:

- Collectibles Medium:

- Ephemera, Cards & Documents Circa:

- Paper Items, General Notes:

- Fuelled by the output from its gold fields, Victoria, and especially Melbourne, was a thriving economy in the second half of the 1800s. The Melbourne Mint had been turning mined gold into coins of the realm since 1872, but the Colony?s commerce remained severely hamstrung by the scarcity of circulating currency, especially the lower denomination silver coins. As early as 1873, the General managers of its leading banks had identified the problem and had petitioned the Governor of Victoria, Viscount Canterbury, to press for the right of the Melbourne Mint to strike silver coins for local use. However, this official file of correspondence printed in 1890 summarised a long and spirited campaign that came to naught. A major problem that was identified concerned the profit or loss associated with striking silver coins. By this time the coins of the British Empire were based solely on the gold standard and so the smaller silver and copper denominations were recognised as ?token? issues only whose ?nominal? values by design exceeded their ?intrinsic? values. In response to the petition by the ?bankers of Melbourne? Mr R. Lingen in his report to the Under Secretary of State for the Colonies noted that ?as far as gold coin is concerned, it is of no consequence whether it be issued from the Mint in the United Kingdom or from a branch Mint in the colony, for it possesses its full nominal value, and the holder, not the state, abides the loss arising out of wear and tear. In the case of silver coinage, however, the state is responsible for wear and tear, and bear(s) the loss on withdrawal.? As added insurance the Royal Mint charged ?one pound sterling for every Twenty shillings (of silver coins struck and distributed), a price considerably in excess of the intrinsic value of the coin? thus securing upfront payment for potential losses incurred when worn coins were withdrawn over time. Mr Lingen also speculated that if Victoria?s request was acceded to then other colonies would similarly petition for the right to strike silver coins and, if these coins were of uniform design then potentially substantial losses might be borne by the United Kingdom if worn coins struck by its branch mints made their way back to its shores. The potential of separating out silver coins by means of a small distinctive ?Mint mark? had already been dismissed as impractical and the adoption of a ?different design for each Mint had also ?not (been) favourably received in the case of gold coinage." So, with no satisfactory means to identify silver coins stuck at branch mints its introduction was effectively stymied and, it remained an insurmountable issue referred to once again in the correspondence of 1874.ÿ Here the ?token? value of the silver coin of the United Kingdom was again reaffirmed and described as having ?the character of a bank note. It is but a symbol of value received, which the issuer is bound to redeem in due course at the value it represents?, even if worn. George Anderson of the Royal Mint, Victoria seems to lay the issue to rest in 1890 when the idea of the Melbourne Mint striking silver coins was again resurrected. He pointed out that the mint?s machinery strikes ?sovereigns admirably and with silver coins no larger than a shilling I think would do equally well, but for the larger coins it would not? without additional machinery and at considerable cost. However, the problem he sees is a different one in that the Melbourne Mint is ?bound to take in all the gold that is brought to us and to pay the depositor its value on about the eighth day, and, as the Mint has no working capital, we are obliged to turn all gold into coin as quickly as possible as the sole way of paying depositors.? He argued that while it is quite possible to strike silver coins, for logistical reasons, ?it is not very desirable? as it would interfere with the Mint?s main obligation to strike gold coins for depositors virtually on demand. Whether the argument continued past 1890 is uncertain but, the need for circulating currency would have been curtailed severely in 1893 when a great depression enveloped the Australian colonies wiping out many of the petitioning banks.

Accepted Forms of Payment:

American Express, MasterCard, Money Order / Cashiers Check, Other, Paypal, Visa, Wire Transfer

Shipping

AUSTRALIA: Purchases within Australia will be charged a MINIMUM SHIPPING FEE of $5.50 and will be sent by Registered Post. Additional insurance is optional at the buyer's expense.

INTERNATIONAL: Overseas purchases will be charged a MINIMUM SHIPPING FEE of $20.00 and will be sent by Registered Post International. Additional insurance is optional at the buyer's expense.

Both Australian and International packages are traceable in transit and require a signature on delivery.

Smalls Auctions

You agree to pay a buyer's premium of up to 20% and any applicable taxes and shipping.

View full terms and conditions

| From: | To: | Increments: |

|---|---|---|

| A$0 | A$249 | A$5 |

| A$250 | A$999 | A$10 |

| A$1,000 | A$4,999 | A$25 |

| A$5,000 | A$9,999 | A$50 |

| A$10,000 + | A$100 |