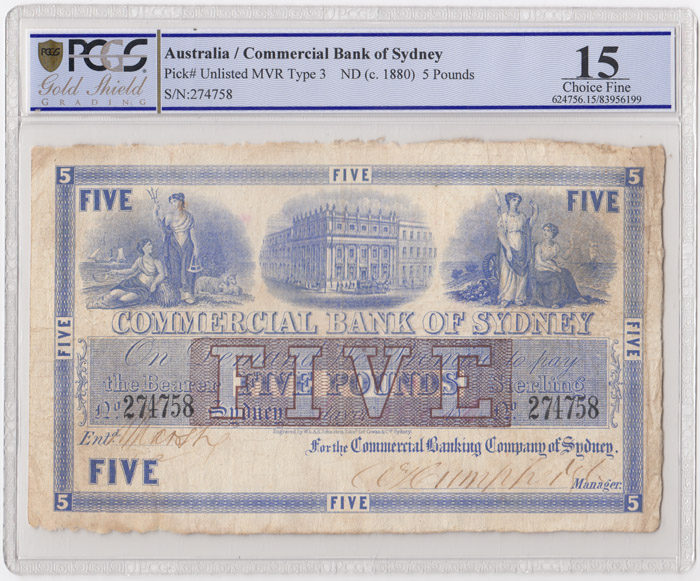

Lot 208

MVR# 3. Sydney domicile. Harshly graded in our opiniom & Very Rare as an issued note

-

Medium:

- Coins, Money & Stamps Notes:

- The 1880s in New South Wales was a period of great prosperity buoyed by high prices paid for wool and coal its two major exports. From 1874 to 1890 European investors poured £44,000,000 of private capital into the Colony to capitalise on the boom which was matched by £36,000,000 of money borrowed by the Government to build new railways, roads and bridges. The Commercial Banking Company of Sydney was riding this wave of prosperity and by 1884, fifty years after its establishment, the value of its banknotes on issue in New South Wales accounted for nearly 26 percent of the total for all the private trading banks, and this was covered by a similar percentage in bank deposits. In retrospect the artificial prosperity that resulted from this unbridled fiscal stimulation masked very large problems in the economy. Australia was, and still is, predominantly an exporter of raw materials and an importer of finished products. Thus when the prices paid for its commodities steadily declined by forty three percent between 1873 and 1893, without a corresponding drop in the prices of imports, reality eventually dawned on the financiers who suddenly became alarmed at the spiralling level of public debt. New South Wales like Victoria had seen an extraordinary property boom through the 1880s when unregulated land banks bought up suburban land with easy money and on-sold it to speculators on suspect valuations. It was described thus: the land was subdivided, it was sold at high prices, but only a deposit paid, promises on paper given for the remainder. As land values began to go up rapidly, sales and re-sales, subdivisions and sub-subdivisions took place, all on deposits and promissory notes. Business in land was tremendous, everybody was making money. Unfortunately the buck stopped in 1893 as the mounting failures of land banks with illiquid assets began to shift attention to the mainstream banks with growing numbers of concerned depositors rushing to withdraw their savings to convert into the safe haven of gold. Although the Commercial Banking Company of Sydney was a very conservative lender and was not overly exposed to the subprime crisis, it too was caught up in the maelstrom having to suspend withdrawals on May 15th, or risk potential default. The Government reacted swiftly to the fall of one of its banking pillars proclaiming the notes of the banks still functioning (as) legal tender thus avoiding further closures. Considered too big to fail the assets of the Commercial Banking Company of Sydney were sold into a new legal entity the Commercial Banking Company of Sydney, Limited and, with the backing of what was effectively a Government Bank Guarantee, was able to re-opened its doors for business on Monday, 9th June 1893. It continued to trade successfully until 1982 when a series of banking mergers saw it absorbed into the National Australia Bank. Condition:

- Paper thin in the bottom left hand corner and a few pin holes

Accepted Forms of Payment:

American Express, MasterCard, Money Order / Cashiers Check, Paypal, Visa, Wire Transfer

Shipping

AUSTRALIA: Purchases within Australia will be charged a MINIMUM SHIPPING FEE of $7.50 and will be sent by Registered Post. Additional insurance is optional at the buyer's expense.

INTERNATIONAL: Overseas purchases will be charged a MINIMUM SHIPPING FEE of $25.00 and will be sent by Registered Post International. Additional insurance is optional at the buyer's expense.(Bulk lots may incur an additional charge)

Both Australian and International packages are traceable in transit and require a signature on delivery.

Smalls Auctions

You agree to pay a buyer's premium of up to 18.5% and any applicable taxes and shipping.

View full terms and conditions

| From: | To: | Increments: |

|---|---|---|

| A$0 | A$99 | A$5 |

| A$100 | A$999 | A$10 |

| A$1,000 | A$4,999 | A$50 |

| A$5,000 | A$9,999 | A$100 |

| A$10,000 + | A$250 |